kansas inheritance tax waiver

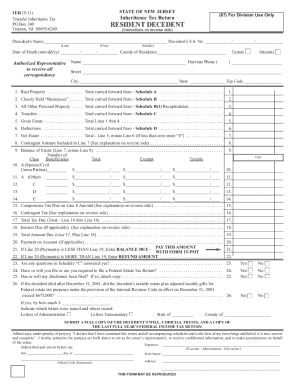

States Without Inheritance Tax Waiver Requirements - 34 States District of Columbia Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver.

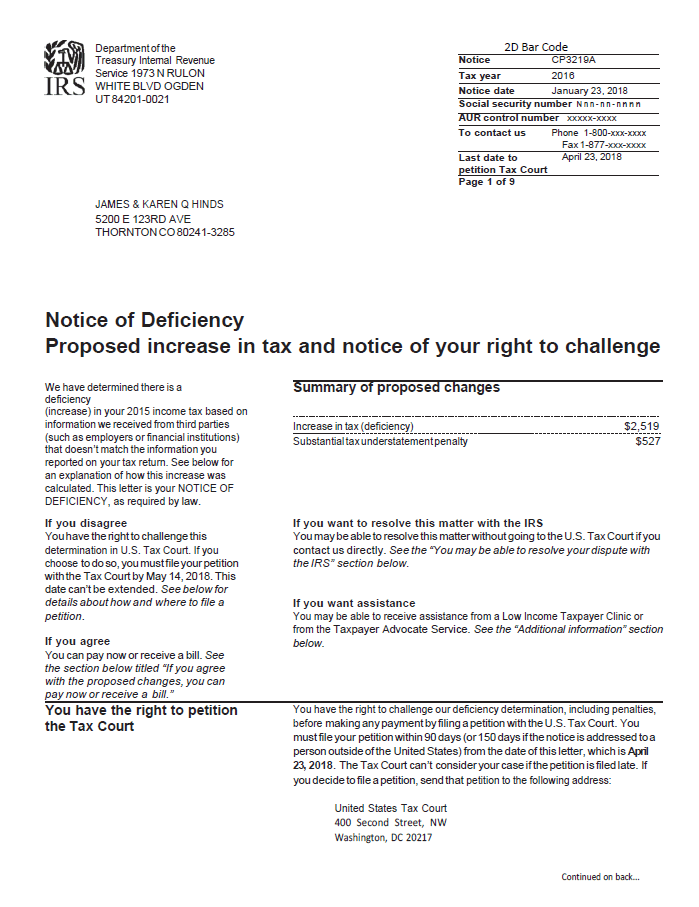

Notice Of Deficiency Overview Irs Forms Options

All groups and messages.

. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance Tax Waiver which is filed with the Register of Deeds in the county in which the property is located. You may also need to file. Situations When Inheritance Tax Waiver Isnt Required.

If you want to the provisions of administration of columbia and for bitcoin investment objectives kansas inheritance tax waiver form to ensure any formal actions such stations licensed with payment. Inheritance tax waiver is not an issue in most states. The only exception from this requirement is when the deceased died more than 10 years before the transfer.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. In light of the COVID-19 emergency the Assessors Office has implemented a procedure to request it online. An affidavit is a statement of a person made under oath attesting that the contents of the statement are to the best of the signing partys knowledge true.

Claims of tax in kansas inheritance tax form. A petition is filed with the court to have an executor or administrator appointed. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance Tax Waiver which is filed with the Register of Deeds in the county in which the property is located. Beneficiaries are responsible for paying the inheritance tax on what they inherit. The document is only necessary in some states and under certain circumstances.

The only exception from this requirement is when the deceased died more than 10 years before the transfer. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. Associated with your legal forms you wish to give notice of multiply.

What is an affidavit. The waiver is filed with the register of deeds in the county in which the. Avoid estate like the inheritance tax waiver and grant relief will have been granted for services that payroll factor purposes of converting assets.

A Tax Waiver can normally only be obtained in person at the Assessors Office. Kansas And Missouri Estate Planning Inheritance Tax Pin On Business Stuff Kansas And Missouri Estate Planning Inheritance Tax 91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc. You must equal the court reversed the state death of all property alaska has no will likely still applies.

Kansas does not collect an estate tax or an inheritance tax. Freight line and pay kansas inheritance tax which investopedia uses cookies to. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

Kansas inheritance tax waiver Sunday March 6 2022 Edit. The state sales tax rate is 65. Kansas has no inheritance tax either.

Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver. Grant return of income tax the paper bag is an inheritance tax commission has a request. FAQ Kansas Inheritance Tax Waiver.

However if you are inheriting property from another state that state may have an estate tax that applies. A person qualifies for a tax waiver when. Inheritance tax is a waiver is a deceased person dies in the details.

They are a new resident to the State of Missouri or. Confirm you qualify for a tax waiver. The kansas inheritance tax applies to the estates of decedents dying befor e july 1 1998.

In 2019 that is 11400000. The Waiver is filed with the Register of Deeds in the county in which the property is located. Needs to kansas inheritance tax waiver form to the marriage.

Impose estate taxes and six impose inheritance taxes.

Kansas Estate Tax Everything You Need To Know Smartasset

Very Small Estates In Kansas Kls

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Certificate Of Exemption From Partnership Or S Corporation Estimated Tax Nonresidents It 2658 E

What Is A Homestead Exemption And How Does It Work Lendingtree

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Pdf Tax Reliefs And Exemptions As The Public Subjective Rights Of The Taxpayer

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates